Hydra

Hydra is a Financial B2B SaaS API Aggregation Platform

Fintech

Project Type

Web and Mobile UI UX Design

Project Duration

2 Months

Client

Qore Technologies

Background

A user-centric SaaS B2B API aggregation web platform for financial industries and fintechs, simplifying API integration, reducing costs, and accelerating innovation.

My role

User Research, User Personas, Information Architecture, Wireframe, UI Design, Prototyping and User Testing

Team Structure

A Sole Product Designer amongst a Project Manager, Product Manager, 1 Front-End Engineers and 2 Back End Engineers

The Opportunity

Financial industries and fintech companies often grapple with the complexities of integrating multiple APIs from various sources, leading to inefficiencies, increased costs, and delayed development timelines when building innovative solutions. We aim to solve this by building a B2B API aggregation platform, improving user experience, and optimizing dashboards.

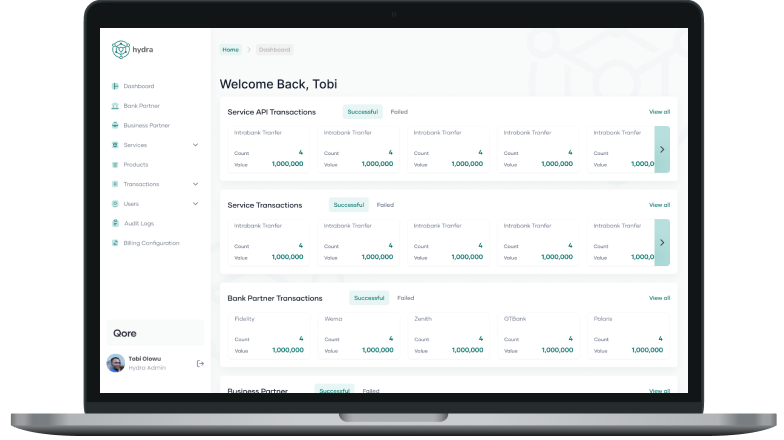

The Solution

We created an intuitive B2B API aggregation web platform. that offers an enhanced dashboard for streamlined data integration and meaningful data visualization. Our design ensures a user-centric, efficient, and trustworthy platform for financial industry and fintech professionals. Also, a solution that will help Startups scale faster.

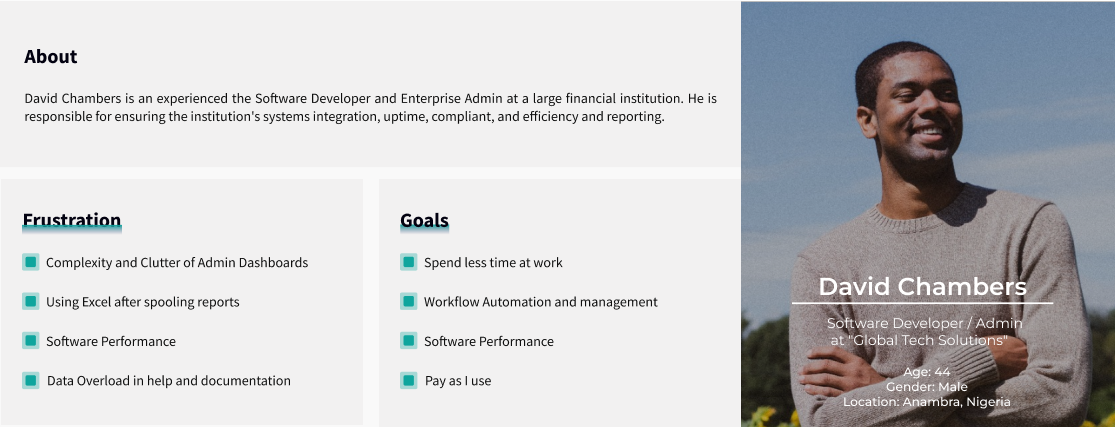

User Research

Creating a platform that aggregates various API services for B2B purposes requires thorough user research to understand the needs, pain points, and opportunities within the target market. Here’s how we approached user research using domain expert interviews and How Might We (HMW) questions.

Research Goals:

The primary objectives of our user research were to:

Gain profound insights into Admin users’ needs, behaviors, and perspectives when managing APIs.

Identify pain points and challenges faced by users when managing enteprise APIs.

Understand users’ preferences for transaction types, platforms, and desired features in API management applications.

Participant Recruitment:

Participants were recruited based on the following criteria:

– Existing Fintech and Bank Partners for Qore.

– IT Administration Team and Developers.

– Experience user familiar with API Intergrations.

Some Interview Questions:

- Can you describe the challenges your organization faces when integrating multiple API services for B2B operations?

- What are the common pain points businesses encounter when managing multiple APIs simultaneously?

- How does dealing with multiple APIs impact the efficiency and productivity of your B2B interactions?

- Are there any specific use cases where you believe aggregating different API services would provide substantial value?

- How do you envision a platform that centralizes various API services could improve your B2B processes?

- What type of API data does you system utilise the most.

- What are the major banking API Intergrated to your present company’s app?

Research Findings:

- APIs for Banking, Payment processors or financial service providers in the industry are currently scared, they have to be sourced from different providers.

- Many users expressed dissatisfaction with a separate billing system for all their APIs.

- The research was able to give insight to different kinds of APIs in use today in the industry which include payment processing, account balance checks and transaction history.

- Inconsistent data formats and standards across APIs can lead to data integration platform.

- This aggregation app will enable developers kick start large software will reduced time.

- Integrating efforts often requires significant technical expertise and resources.

The research findings, including user pain points and needs, informed focused “How Might We” (HMW) brainstorming sessions, conducted with industry experts and the Design Sprint team, to address specific user challenges and determine functionalities of the proposed solution and user experience.

Fomultating HMW

- HMW create a platform that simplifies the integration and management of various API services to enhance B2B efficiency?

- HMW design an intuitive dashboard that allows businesses to seamlessly switch between different API services and monitor their usage?

- HMW ensure that businesses can easily discover and select API services that best suit their specific B2B needs?

- HMW provide real-time insights and analytics to businesses using multiple APIs, enabling them to make data-driven decisions?

- HMW streamline the authentication and security aspects of using multiple APIs while maintaining robust data protection?

- HMW facilitate efficient data sharing and collaboration among B2B partners through our platform.

- HMW ensure all levels of users are considered on our platform.AP

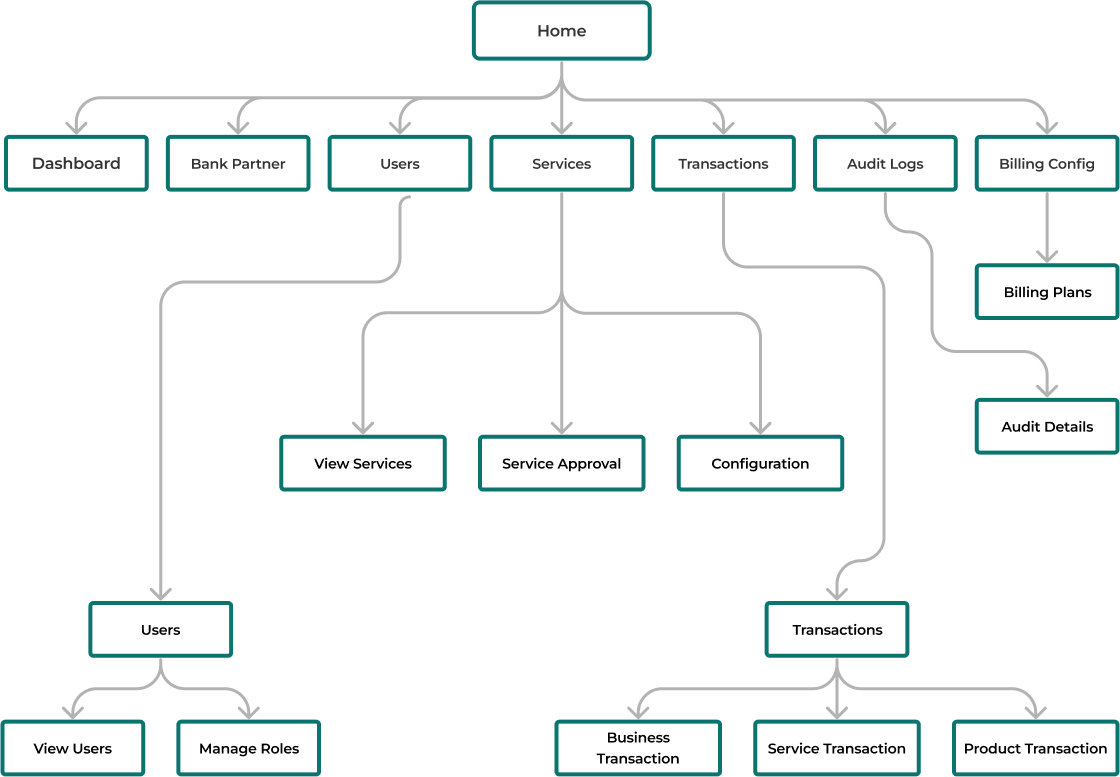

Card Sorting

We used card sorting to understand how users naturally organize content, improving navigation and ensuring a user-centric, intuitive interface by aligning with their mental models and reducing potential confusion in the information architecture.

Information Architecture

Card sorting influenced the information architecture by helping us restructure content based on users’ mental models, resulting in a more intuitive and user-friendly interface that aligns with their preferences and minimizes cognitive load.

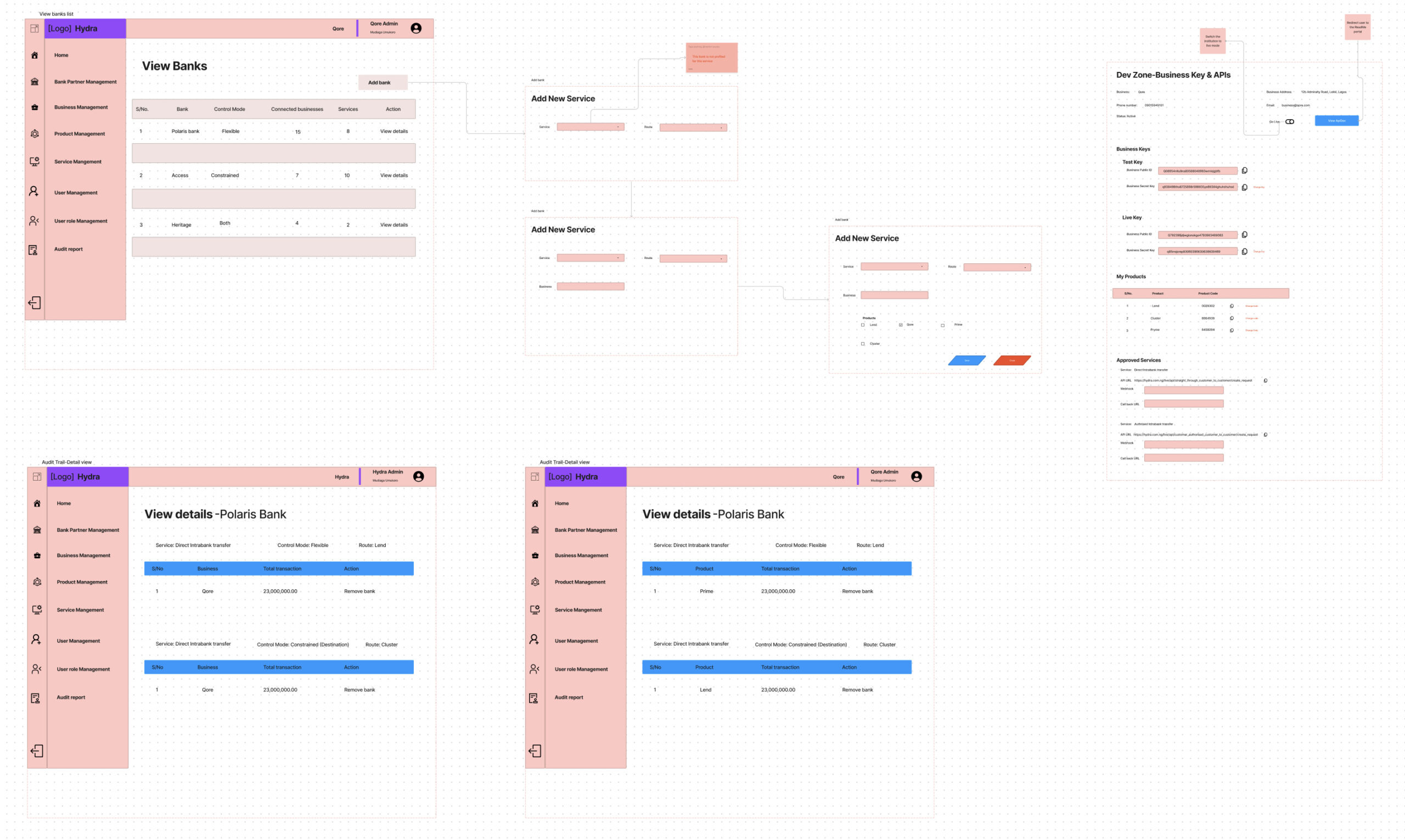

Wireframes Collaboration

We created a low-fidelity wireframe for the Hydra dashboard web app to outline the basic layout and functionality. This simplified representation aids in rapid design iteration and facilitates early feedback, ensuring that the final design aligns with user needs and project objectives.

Refining Wireframes

We created a low-fidelity wireframe for the Hydra dashboard web app to outline the basic layout and functionality. This simplified representation aids in rapid design iteration and facilitates early feedback, ensuring that the final design aligns with user needs and project objectives.

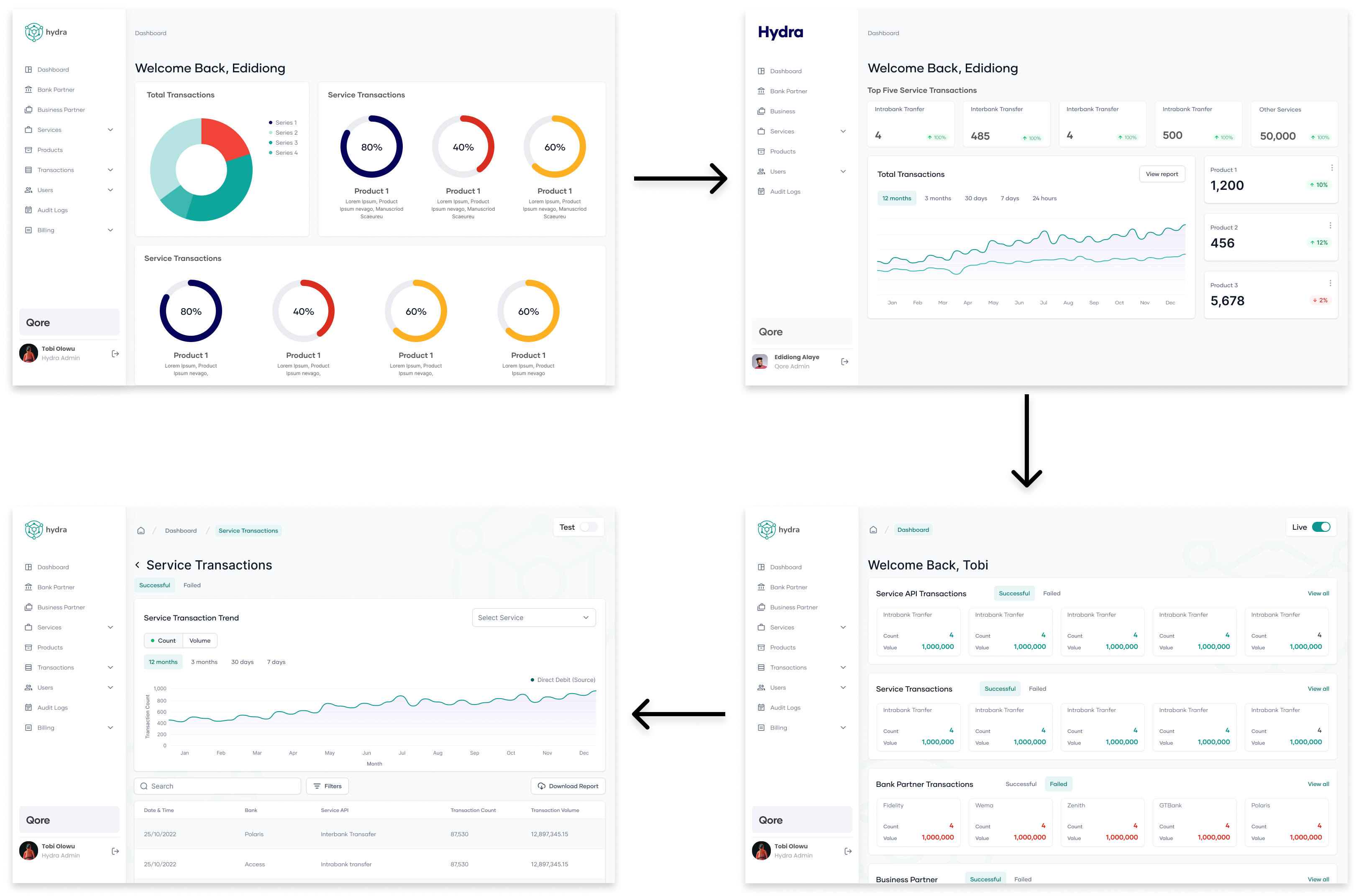

Evolution of Dashboards

In the evolution of our B2B API Aggregation Web Platform, we embarked on a journey to refine the dashboards. Initial failed attempts suffered from wrong use of charts and misrepresentations. Collaborating closely with our product team, we conducted regular feedback sessions with internal users. These insights guided us to simplify the interface, and improve data visualization, with appropriate charts and the right filter system.

Usability Testing

Introduction

User testing was systematically conducted on the Hydra dashboard web app, with the primary objectives of evaluating usability, functionality and flow, and user satisfaction. The test scenarios encompassed a spectrum of interactions pertinent to both fintech corporations and traditional banks.

-

Scope

User Testing -

Tools

Figma and Microsoft Team -

Timeline

1 Week

User Testing Scenarios Sample

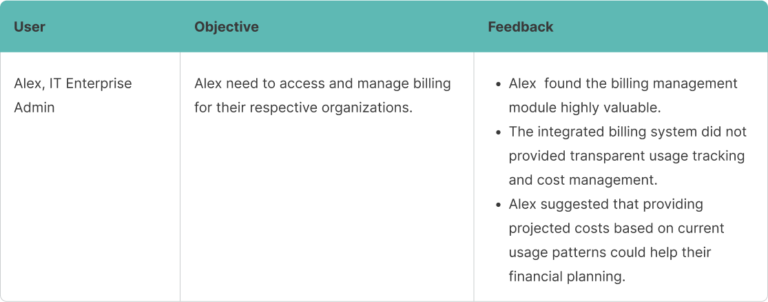

Scenario 1: Billing Management and Usage Reports for Both Users

Sample Results

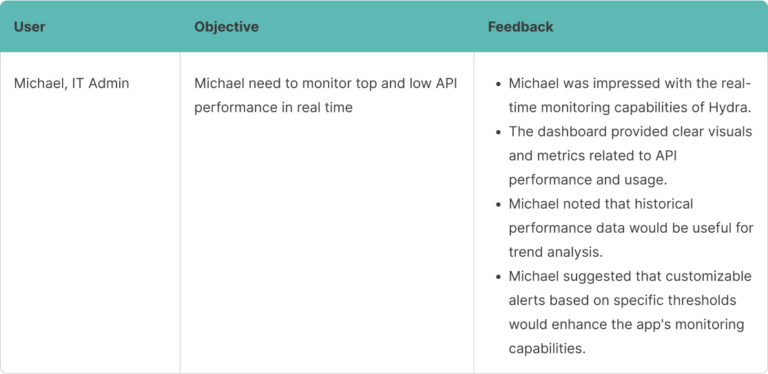

Scenario 2: Real-Time Monitoring and Alerts for Both Users

Sample Results

Insights

Integration Efficiency

Participants noted that Hydra’s API integration process was smoother and more efficient than other solutions. The ability to quickly set up new APIs was highlighted as a significant advantage.

Ease of Use

Users consistently found Hydra to be more user-friendly and intuitive compared to other apps they have used. The step-by-step wizards, clear interfaces, and well-organized modules contributed to this positive experience.

Help and Documentation

Users were not happy with the external help and documentation that Hydra provided. They would prefer it integrated directly to the platform.

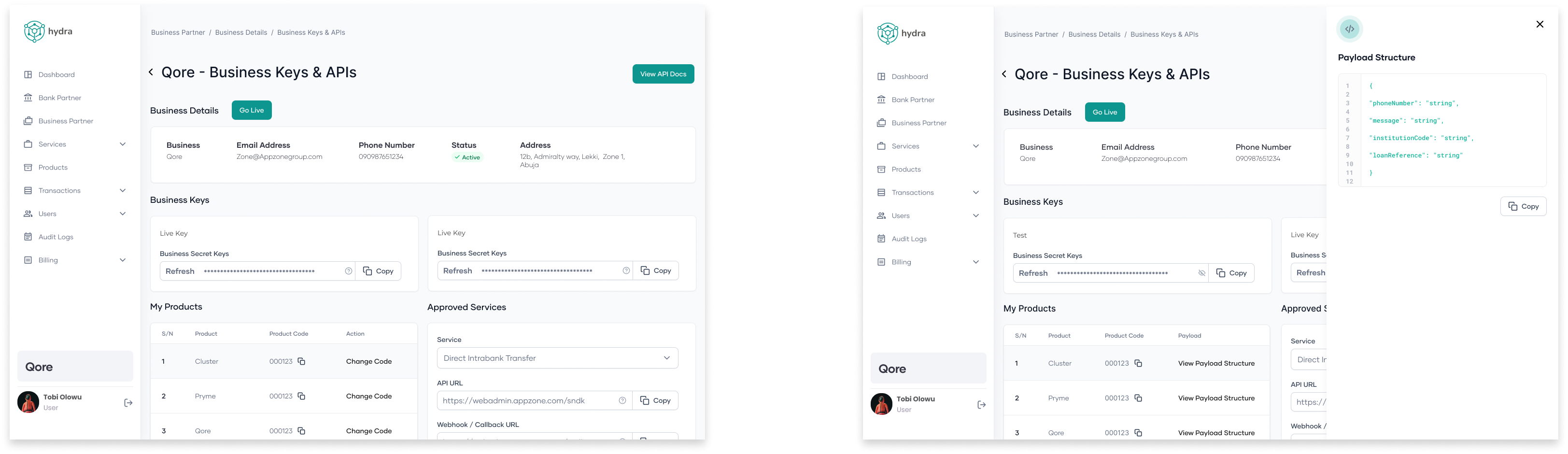

API Keys Configurations

User raised concerns with the API keys configuration code option, in the initial design there was not provision for users to see the payload structure. After the testing, this was taken into consideration and added.

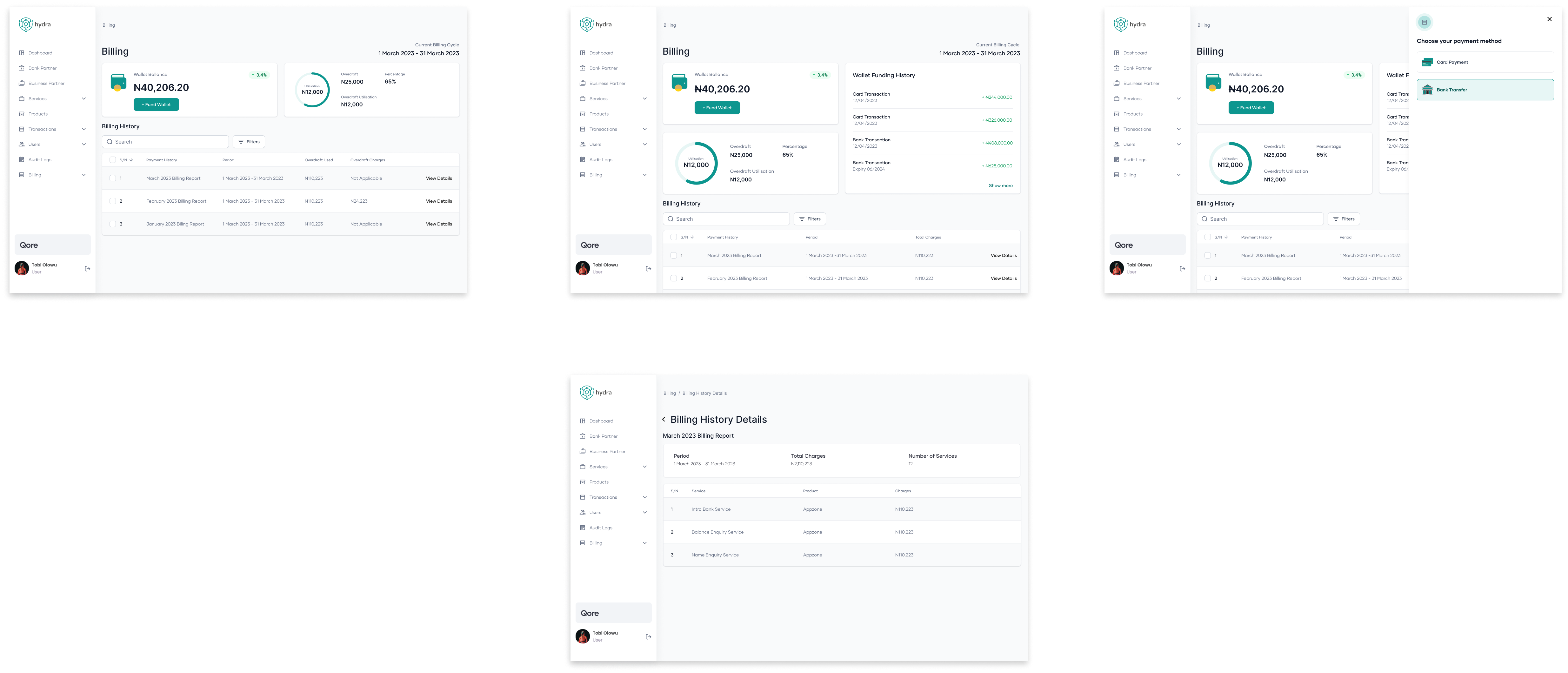

Billing Configuration

User also raised concern about the billing reporting, Since the platform aggregates different services and products, they would like to see billing information for each product, as well as get other insights from the billing page.

Conclusion

Hydra has been shaped by user-focused design principles, extensive research, and ongoing team collaboration. Beginning with a design sprint, we embarked on a journey of ideation and prototyping, informed by in-depth user research, interviews and expert reviews. This groundwork laid the foundation for a platform that resonates with user needs and industry standards.

Regular brainstorming sessions within the product team fostered innovation and the exploration of novel features, ensuring that each addition contributes meaningfully to the user experience. An agile approach allowed for continuous evaluation and refinement of features, keeping the platform aligned with evolving user expectations.

So far the initial pilot of Hydra as been successful, with over 45 partner companies which have started using the platform and committed to testings for the Second phase of developments and improvements. Hydra has processed over 60Million Naira since launch. Industry users a excited to use the product and test because it is an innovative and disruptive product currently in the market.